The Ultimate Guide To Unicorn Finance Services

Table of ContentsThe Single Strategy To Use For Unicorn Finance ServicesUnicorn Finance Services Can Be Fun For EveryoneThe Greatest Guide To Unicorn Finance ServicesWhat Does Unicorn Finance Services Mean?Fascination About Unicorn Finance ServicesAn Unbiased View of Unicorn Finance Services

We independently examine all recommended services and products. If you click on links we give, we may get compensation. Discover a lot more. A home loan broker acts as an intermediary between someone who wishes to acquire property and those providing financings to do so. Home loan brokers assist potential consumers find a loan provider with the ideal terms as well as rates to meet their economic needs.

They additionally gather and validate all of the required documentation that the loan provider requires from the consumer in order to finish the house acquisition. A home loan broker commonly collaborates with several loan providers and can supply a range of loan choices to the customer. A consumer does not have to function with a mortgage broker.

Unicorn Finance Services for Beginners

While a mortgage broker isn't required to facilitate the deal, some lending institutions may only overcome home mortgage brokers. So if the loan provider you favor is amongst those, you'll need to use a home loan broker. A financing police officer benefits a lending institution. They're the person that you'll deal with if you approach a lending institution for a funding.

They'll respond to all concerns, assist a debtor get pre-qualified for a loan, and aid with the application procedure. They can be your advocate as you work to shut the financing. Home mortgage brokers do not offer the funds for fundings or authorize car loan applications. They help individuals seeking home mortgage to locate a lender that can fund their residence acquisition.

After that, ask pals, relatives, and also business colleagues for recommendations. Have a look at on the internet evaluations and look for issues. When conference possible brokers, get a feel for how much interest they have in assisting you obtain the lending you need. Inquire about their experience, the precise aid that they'll provide, the charges they bill, and also just how they're paid (by lending institution or debtor).

The 10-Minute Rule for Unicorn Finance Services

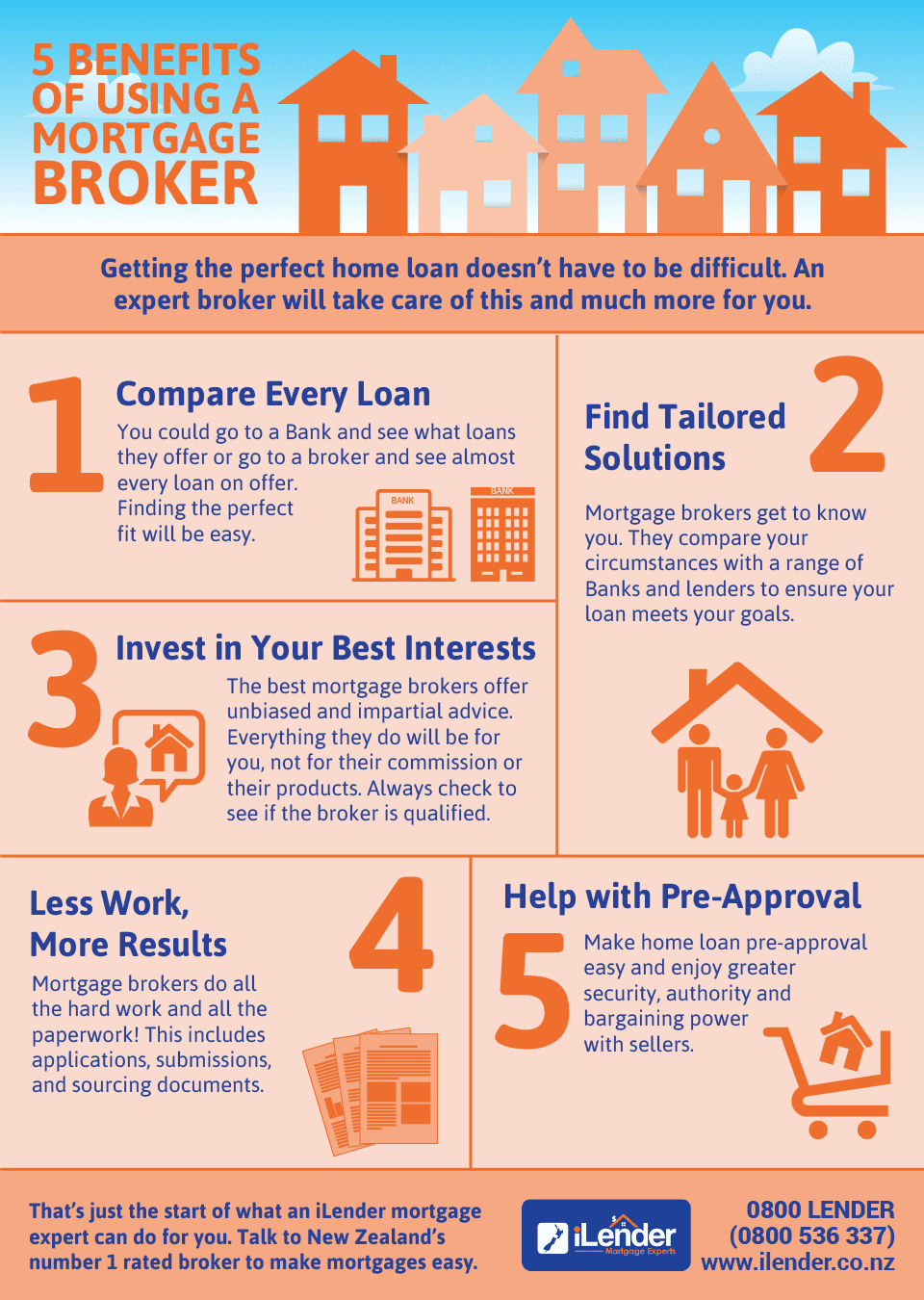

Right here are 6 advantages of using a home loan broker. Home mortgage brokers are extra adaptable with their hrs and sometimes going to do after hrs or weekends, meeting each time and location that is practical for you. This is a big benefit for full-time workers or family members with commitments to consider when wanting to locate a financial investment residential or commercial property or marketing up as well as carrying on.

When you consult with a mortgage broker, you are effectively obtaining access to several financial institutions and their loan alternatives whereas a bank only has accessibility to what they are using which might not be fit to your needs. As a home capitalist, locate an experienced home loan broker who is focused on giving property financial investment finance.

The 25-Second Trick For Unicorn Finance Services

This enables it to end up being extremely free from what your loaning power actually is as well as which lending institutions are one of the most likely to lend to you. This assists you to recognize which lenders your application is probably to be effective with and also lowers the chance that you'll be transformed down many times as well as marks versus your debt history.

A lot of brokers (nonetheless not all) gain cash on payments paid by the lender as well as will entirely depend on this, giving you their services absolutely free. Some brokers might gain a greater compensation from a particular lender, in which they may be in favour of as well as lead you in the direction of.

An excellent broker collaborates with you to: Comprehend your needs and also objectives. Exercise what you can afford to obtain. Locate choices to match your situation. Discuss how each financing works and also what it sets you back (as an example, rates of interest, functions and also fees). Use for a financing and also take care of the procedure through to negotiation.

A Biased View of Unicorn Finance Services

Some brokers obtain paid a conventional fee regardless of what loan they suggest. Other brokers get a greater fee for providing certain fundings.

If the broker isn't on one of these lists, they are operating unlawfully. Prior to you useful source see a broker, believe regarding what issues most to you in a home loan.

Make a checklist of your: 'must-haves' (can't do without) 'nice-to-haves' (can do without) See choosing a mortgage for suggestions on what to take into consideration. You can find a qualified home loan broker through: a mortgage broker professional organization your loan provider or banks suggestions from individuals you know Bring your list of must-haves as well as nice-to-haves.

Things about Unicorn Finance Services

Get them to explain just how each financing choice functions, what it costs and why it's in your ideal passions. If you are not delighted with any kind of choice, ask the broker to locate alternatives.